Applying For Chase Ink Business Cards: What You Need To Know

Chase has some of the all around best credit cards, in terms of the welcome bonuses, return on spending, and perks. This is especially true with the issuer’s business credit cards.

For example, the Ink Business Preferred® Credit Card (review) has the single best welcome bonus of any credit card right now, and I’d argue is the most well-rounded business credit card. Meanwhile, the no annual fee Ink Business Cash® Credit Card (review) and Ink Business Unlimited® Credit Card (review) have their best-ever welcome bonuses right now, and are generally great cards for maximizing points.

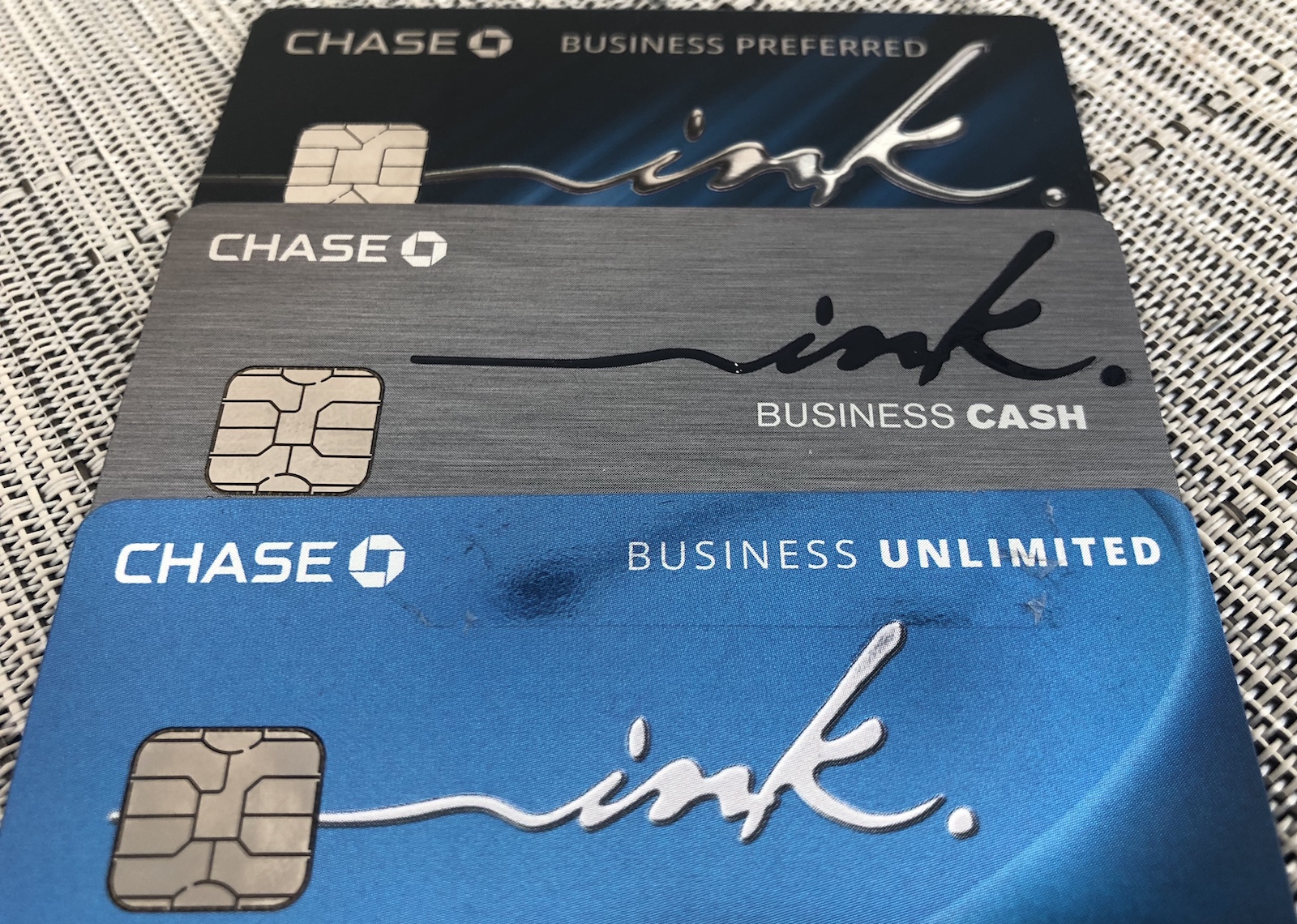

I have all three of these cards, so in this post, I wanted to take a closer look at who is eligible for these cards, and how you can go about getting approved for all of them.

Chase Business Cards Easier To Be Approved For Again

Towards the start of the pandemic, most card issuers got a lot stricter with approving individuals and small businesses for credit cards. That’s understandable, given the uncertainty, and the exposure card issuers have. Reports at the time suggested that:

Chase stopped approving sole proprietorships for small business cards

In order to be approved for a Chase business card you had to be logged into a Chase account (in other words, Chase was only approving existing non-sole proprietorships for cards)

Even for those people, approvals seemed to be few and far between

Fortunately as of the past few months that trend seems to have reversed, and anecdotally it appears that Chase business cards are a bit easier to be approved for again:

Sole proprietorships are once again being approved for business cards

You don’t have to log into a Chase account to apply for a business card

There seem to be more reports of approvals across the board

That’s no guarantee that you’ll be approved if you apply, but it’s at least nice to hear that more people are once again being approved for Chase business cards.

With that out of the way, let’s get into some general tips for being approved for Chase business cards…

Who Is Eligible For Chase Business Cards?

Eligibility for a small business credit card is easier than you might think. You don’t need to have a big company, and don’t even need to be incorporated. Even a small side business with limited business revenue makes you eligible for a business credit card, even if you’re just selling things on eBay, do some consulting on the side, have a rental property, or do freelancing, for example.

It goes without saying that you should always fill out credit card applications truthfully.

What Are Restrictions On Applying For Chase Business Cards?

Chase’s general restrictions on applying for cards are as follows:

There’s no hard limit on how many Chase credit cards you can be approved for, but rather there’s often a maximum amount of credit Chase is willing to extend you, in which case you may be asked to switch around your credit limits on some cards in order to facilitate an approval

There are inconsistent data points as to how long you have to wait between applications; my recommendation is to wait 30 days between Chase business card applications to be on the safe side

Chase business cards are subjected to the 5/24 rule, whereby you typically won’t be approved if you’ve opened five or more new card accounts in the past 24 months; I’ll talk more about how that works below

You can have (and earn the bonus) on each of the three “Ink” cards, so if you have the Ink Business Preferred you’re eligible for the Ink Business Cash and Ink Business Unlimited

How Should You Fill Out A Chase Business Credit Card Application?

Those who already have business credit cards are probably familiar with the application process, but for those who aren’t, here’s what you need to know. It can be intimidating to apply for your first business credit card, though even if you’re a small business or sole proprietorship, you should be eligible.

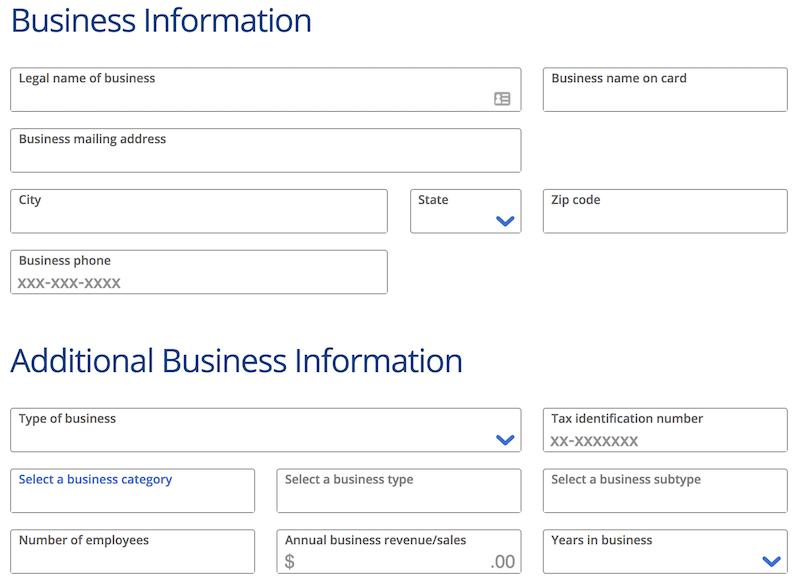

When applying for a Chase business card, you’ll be asked the following questions, in addition to the typical personal questions about your income, Social Security Number, etc.:

Legal name of business

Business mailing address & phone number

Type of business

Tax identification number

Number of employees

Annual business revenue/sales

Years in business

If you’re a sole proprietorship, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

You can use your name as the legal name of your business

The business mailing address and phone number can be the same as your personal address and phone number

If you’re a sole proprietorship, you can select that as your type of business

For the tax identification number, you can put your social security number

For number of employees, saying just one is perfectly fine

For your annual business revenue, there’s nothing with saying zero, or whatever the amount is

For years in business, there’s no shame in saying that it’s new, that it has been 1-2 years, etc.

How Hard Is It To Get Approved For A Chase Business Credit Card?

When it comes to getting approved for business credit cards, Chase certainly isn’t the easiest issuer. In general I find American Express business cards to be easiest to be approved for. However, getting approved for Chase business cards isn’t as tough as some people assume, at least if you have excellent credit.

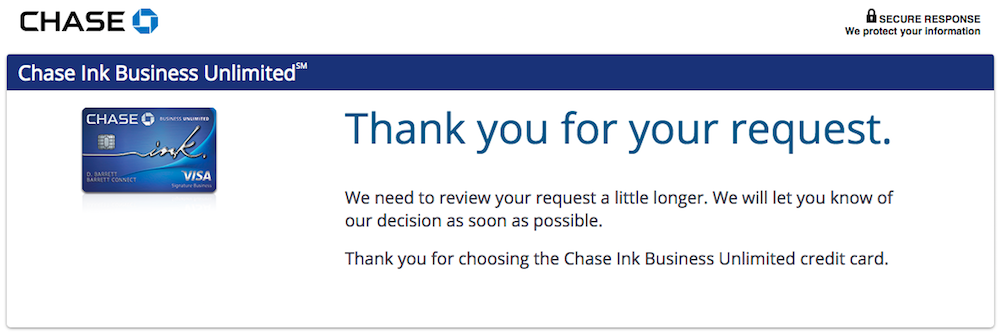

In my experience instant approvals on Chase business cards are fairly rare, so don’t be worried if the approval doesn’t come through right away. You’ll usually get a pending decision response, and then eventually (hopefully) an approval.

For example, I’ve had the Ink Business Cash for many years, and then in late 2018 was approved for both the Ink Business Preferred and Ink Business Unlimited. In both cases, I didn’t get an instant decision.

What Are The Best Chase Business Credit Cards?

There are three especially worthwhile Chase business cards to consider right now, and you’re eligible for all three of them, potentially (which means that you can earn the bonus on a version of the card if you already have another version).

First there’s the Ink Business Preferred, which I consider to have the best welcome bonus of any credit card out there at the moment:

Welcome bonus: 100,000 Ultimate Rewards points after spending $15,000 within three months

Annual fee: $95

Return on spend: 3x points on the first $150,000 of combined purchases per account anniversary year on travel, shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines

Then there’s the Ink Business Cash, which has its best-ever welcome bonus at the moment:

Welcome bonus: $750 cash back (which can potentially be converted into 75,000 Ultimate Rewards points) after spending $7,500 within three months

Annual fee: $0

Return on spend: 5x points on the first $25,000 of combined purchases per account anniversary year at office supply stores, and on internet, cable, and phone services, as well as 2x points on the first $25,000 of combined purchases per account anniversary year at restaurants and gas stations

Then there’s the Ink Business Unlimited, which also has its best-ever welcome bonus at the moment:

Welcome bonus: $750 cash back (which can potentially be converted into 75,000 Ultimate Rewards points) after spending $7,500 within three months

Annual fee: $0

Return on spend: 1.5x points on all purchases

There are some other excellent co-branded Chase business cards worth considering as well, including the following:

Southwest Rapid Rewards® Performance Business Credit Card (review)

Southwest Rapid Rewards® Premier Business Credit Card (review)

UnitedSM Business Card (review)

Is There An Ideal Order In Which To Apply For Chase Cards?

Given that applying for Chase business cards won’t count towards your 5/24 limit, in general I’d recommend applying for Chase business cards before applying for Chase personal cards.

If it were me, I’d pick up the Ink Business Preferred first (since I consider it to be the most well rounded of the three cards), and then would pick up either the Ink Business Cash and/or Ink Business Unlimited, depending on whether you value the 5x points in select categories, or 1.5x points across the board, more.

Of course this assumes you’re able to achieve the minimum spending on the Preferred. If that’s out of the question, then I’d start with the Ink Cash and/or Ink Unlimited.

How Does The 5/24 Rule Impact Chase Business Credit Cards?

Chase has what’s known as the 5/24 rule, whereby you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months.

One exception is most business cards, including those issued by American Express, Bank of America, Barclays, Chase, and Citi, generally won’t count as an additional card towards that limit, because they won’t be shown on your personal credit report.

You will want to check your 5/24 status before applying for a Chase business card. One positive thing is that while Chase business cards are subjected to the 5/24 rule, when you’re approved for them they don’t count as a further card towards that limit.

In other words, if you’ve opened four new accounts in the past 24 months and then apply for a Chase business card, you’ll still be at four cards. If you then apply for another Chase business card, you’ll still be at four cards.

See this post for everything you need to know about the 5/24 rule for Chase business cards.

Bottom Line

Chase has some fantastic credit cards, and in particular, the issuer has great business credit cards. This includes the card that I consider to have the single best welcome bonus out there, as well as a cards with best-ever welcome bonuses right now.

Not only do the cards have great initial bonuses, but they have excellent bonus categories, ranging from 1.5x points on all purchases, to 3-5x points in select categories.

Applying for business credit cards in general can be intimidating for new businesses, though I recommend giving it a try using the above tips, and you’ll probably be pleasantly surprised by the results.

While Chase business cards have been extremely difficult to get approved for the past several months, it looks like that trend has finally been reversed, and we’re seeing more approvals once again.

The post Applying For Chase Ink Business Cards: What You Need To Know appeared first on One Mile at a Time

Read more: onemileatatime.com

The post Applying For Chase Ink Business Cards: What You Need To Know appeared first on Patrizia Wish.

source http://patriziawish.com/applying-for-chase-ink-business-cards-what-you-need-to-know/

Comments

Post a Comment